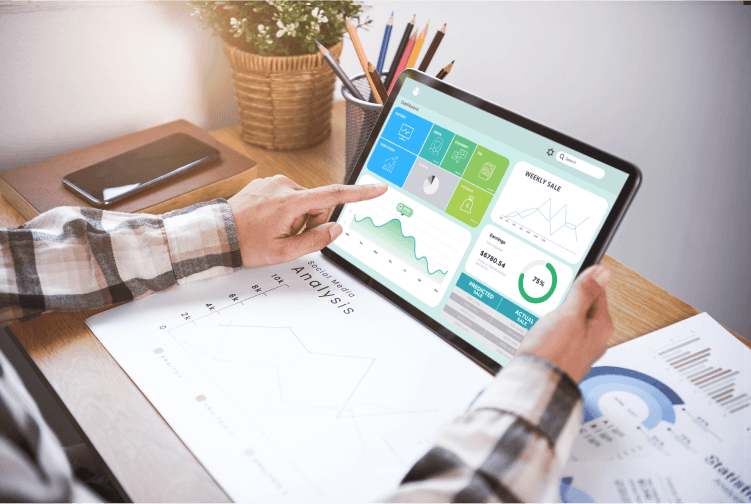

In the world of mortgages, doing well isn’t just about money. It's also about building strong relationships with clients. Customer Relationship Management (CRM) systems are like secret weapons for mortgage companies. They help manage customers and make everything run smoothly.

In this article, we'll look at why mortgage CRM solutions are so important in mortgages. We'll see how they make things easier, keep clients happy, and help businesses grow, even when times are tough.

The Importance of Mortgage CRM Solutions

CRM systems are super important in the mortgage world. They help manage how we interact with customers and handle all the complicated stuff involved in mortgages.

In an industry where client relationships are crucial, CRM for mortgage companies act like central hubs. They store important customer information, like who they've talked to and what they've done. By putting all this info in one place, CRM systems help mortgage professionals give personalized service and respond quickly to client questions. And they also save time by doing things like managing leads and sending emails automatically.

This means loan officers and brokers can spend more time building relationships, choose the right the approach and close deals.

What's more, mortgage CRM solutions give insights into what customers like and how they behave. This helps mortgage companies predict what customers might need next, tailor their services, and make sure customers are happy.

In a competitive market, where giving great customer service is a must, CRM systems are essential for growing a business, building trust, and making sure a mortgage company does well in the long run.

10 Best CRM For Mortgages in 2024

1. Salesforce Mortgage Cloud

This tool is packed with features made just for mortgage lenders. Salesforce mortgage CRM helps with everything from finding leads to getting loans approved. And it gives lenders important info about customers and trends in the market. Plus, Salesforce mortgage CRM works well with other tools commonly used in mortgages, like credit checks and document management.

2. Velocify by Ellie Mae

Velocify is a top mortgage crm and great at managing leads. It helps lenders keep track of who's interested in getting a mortgage and makes sure the right loan officers talk to them. It also takes care of things like sending emails and scheduling appointments. And this CRM software for mortgage brokers makes sure all interactions with customers follow the rules.

3. SimpleNexus

SimpleNexus makes it easy for loan officers to work on the go. They can use their phones to see important info and talk to customers. And mortgage CRM solutions can share and sign documents securely. It also keeps customers in the loop with real-time updates on their loan applications.

4. Mortgage iQ CRM

Mortgage iQ CRM helps keep track of all the loans in progress. It gives a clear view of what's happening with each one, so decisions can be made faster. It also helps send out messages to customers at key points in the loan process. And Mortgage iQ CRM gives detailed reports to help improve how things are done.

5. Jungo

Jungo works well with the systems lenders use to start loans. It saves time by moving information between systems automatically. It also takes care of sending emails and reminders, so customers get answers quickly. And it makes sure everything follows the rules.

6. Shape Software

Shape Software lets mortgage professionals set things up just how they like. They can make sure leads are managed the way they want and set up messages to customers. It also helps everyone on the team work together better. And customers can use mortgage CRM to upload documents and keep track of their loans.

7. Surefire CRM by Top of Mind Networks

Surefire CRM helps mortgage professionals send out emails that customers will like. It helps keep track of who's referred new customers and who's interested in getting a loan. And mortgage CRM looks at past info to predict what might happen in the future.

8. BNTouch Mortgage CRM

BNTouch Mortgage CRM takes care of lots of things, like getting new leads and sending messages to customers. It also helps keep track of what needs to be done, so nothing gets forgotten.

9. Mortgage Automator

Mortgage Automator makes it easier for lenders to start loans. Mortgage CRM solutions put everything in the cloud, so there's less paperwork to do. And it works with accounting software to make sure everything adds up.

10. Whiteboard Mortgage CRM

Whiteboard Mortgage CRM is simple to use. It reminds loan officers of what needs to be done and helps keep track of new customers. And Whiteboard Mortgage CRM helps loan officers see how each lead is doing, so they know who to talk to next.

Each mortgage CRM system has special features that help mortgage professionals do their jobs better. Whether it's making things run smoother, talking to customers, or following the rules, these systems play a big part in making sure mortgage companies do well. By using the best mortgage CRM software, these companies can make things easier, keep customers happy, and stay ahead of the competition.

Relevant Articles: