Bulgaria and Romania stand out as top picks in Eastern Europe for IT outsourcing, where you can find talented developers at prices that make sense, all while staying close to Western Europe. This deep dive pulls from solid market reports and industry insights to stack them up on important factors, helping businesses like yours find the right fit for trustworthy partnerships.

Market Overview and Growth Trends

Romania's IT scene has really taken off, turning into a major player with its outsourcing market hitting around $415 million in 2024 and set to grow at about 8.74% each year through 2025. That's thanks to a huge workforce of 200,000 to 280,000 IT experts spread across more than 440 software companies, making it the biggest nearshore spot in Europe after Ukraine. Places like Bucharest, Cluj-Napoca, and Timișoara are buzzing with innovation, drawing in big names such as Microsoft, Oracle, and UiPath, which started right there and now has a market cap over $10 billion. The industry adds about 7 to 8% to Romania's GDP, with outsourcing income jumping 15 to 20% yearly lately, leaving many competitors in the dust.

On the other side, Bulgaria might be a bit smaller, but it's making big waves with an IT outsourcing market expected to reach $145 to $180 million by 2025, accounting for roughly 5.5% of the country's GDP. In 2024, they added 2,675 new IT jobs, and revenues grew by 12% from the year before, especially in key spots like Sofia and Plovdiv. With over 2,400 software firms in operation, many holding top certifications like CMMI Level 5, they're serving clients including SAP, IBM, and VMware. Looking ahead, Bulgaria's ICT market is on track for 8% annual growth through 2031, boosted by EU funding and a steady economy after joining Schengen.

Both countries enjoy EU perks, like GDPR for data security and easy dealings with Western clients. Romania's bigger scale suits huge projects, but Bulgaria's quick rise and easier entry make it great for smaller businesses. Lately, reports show Southeast Europe booming in outsourcing, with these two countries grabbing 70% of the regional share.

Talent Pool and Education Systems

Romania has one of Europe's biggest IT talent pools, with 200,000 to 280,000 professionals overall, including more than 140,000 software developers. Schools like Politehnica Bucharest and Babeș-Bolyai pump out 20,000 STEM grads every year, zeroing in on areas like AI, cybersecurity, and cloud tech. They're tops in Europe for certified IT folks per person, shining in full-stack development, DevOps, and big enterprise software, think UiPath's lead in robotic process automation. This steady flow of new talent helps with scaling up, though snagging the best senior pros can be tough due to demand.

Bulgaria holds its own with 100,000 to 105,000 IT specialists, including over 50,000 developers, and the numbers are climbing 10 to 12% each year. Institutions, like Sofia University, are producing sharp coders skilled in .NET, Java, and React, with more than 12,000 new IT pros joining the workforce annually. They stand out in backend and data engineering, prioritizing quality, and many companies boast ISO 27001 and CMMI certifications.

Bulgaria's tech education gets high marks worldwide, delivering solid engineers without breaking the bank on training. When it comes to total IT specialists, Bulgaria has 100,000 to 105,000 while Romania boasts 200,000 to 280,000. For software developers, it's about 50,000 in Bulgaria compared to around 140,000 in Romania. Annual new graduates top 12,000 in Bulgaria and over 20,000 in Romania. Certifications highlight CMMI Level 5 and ISO for Bulgaria, with Romania leading as Europe's number one in certified pros. Romania takes the win for sheer numbers, perfect for big-team needs, while Bulgaria brings deeper expertise for niche jobs.

Cost Analysis and Salary Benchmarks

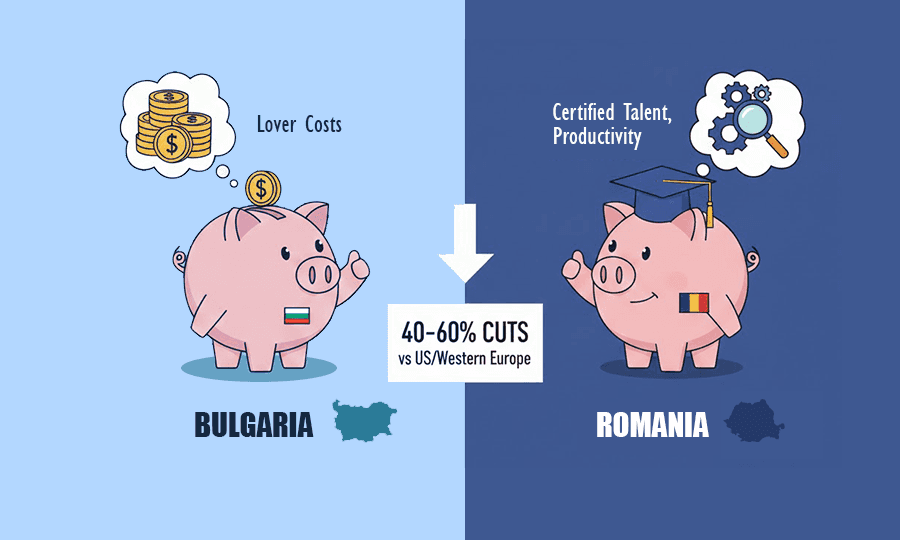

Saving money is a big reason to outsource, and both spots offer 40 to 60% cuts compared to US or Western Europe rates, which often top $100k a year. IT outsourcing in Bulgaria really stands out on costs: senior developers average $50,600 to $76,000 USD yearly (BGN 90,000 to 130,000), with juniors at $25,000 to $35,000. Hourly rates for seniors sit at $30 to $50, a bit lower than Romania thanks to cheaper living in Sofia, about 50% below Bucharest.

Romania's figures are a touch higher, with seniors averaging $71,600 USD (RON 350,000 plus), Java devs around $25,000 USD (RON 112,760 gross), and top ICT roles up to $90,000. Outsourcing hours go for $35 to $60. Sure, it's more expensive, but the productivity from their certified talent makes up for it on tricky projects. Breaking it down by role, junior developers earn $25k to $35k in Bulgaria and $20k to $30k in Romania. Mid-level devs get $40k to $55k in Bulgaria versus $45k to $60k in Romania. Seniors pull $50k to $76k in Bulgaria compared to $70k to $90k in Romania. Hourly outsourcing is $30 to $50 in Bulgaria and $35 to $60 in Romania. Bulgaria feels more wallet-friendly for startups, while Romania's premium pays off with its scale.

English Proficiency and Communication

Good communication makes or breaks outsourcing deals. Romania ranks 11th globally in the 2025 EF English Proficiency Index, scoring a very high 605 out of 800, especially strong in business English that's vital for US and EU clients. Over 80% of their IT folks are fluent, making teamwork smooth and easy.

Bulgaria comes in at 25th with high proficiency, particularly among younger pros where over 70% are fluent in tech centers, though it dips a bit in complex business talks. Both beat world averages, cutting down on mix-ups. Romania's advantage here speeds up getting started, especially for folks who aren't tech-savvy.

Time Zones and Operational Synergy

Both countries run on Eastern European Time (EET, UTC+2, or UTC+3 during daylight saving), lining up perfectly with Central Europe, just 1 to 2 hours from the UK, and 6 to 9 hours from the US East Coast, ideal for nearshoring. You can hop on real-time calls without the headaches of Asia's 12-plus hour differences. Bulgaria's post-EU stability adds to its dependability.

Pros and Cons Breakdown

Let's talk about Bulgaria first. On the plus side, it offers super competitive costs and great value from its talent. As an EU member with low geopolitical risks and full Schengen access by 2026, it's a safe bet. They excel in custom software and fintech, with a growing eye on AI. Infrastructure is top-notch with 99% broadband coverage, and IT growth is at 8%. But there are downsides: the smaller talent pool can limit huge projects, this happens due to the brain drain to Western Europe.

Now for Romania. Strengths include a massive, certified talent pool ready for any size job. It's an innovation hotspot, home to UiPath and Bitdefender, with sector growth over 15%. English skills are elite, and they align well culturally with the West. Expertise spans cybersecurity, blockchain, and enterprise apps. Drawbacks? Salaries are creeping up, chipping away at cost savings. Bureaucracy can slow things, and there are occasional data security slips in some setups. Local competition is fierce, leading to talent poaching.

Both countries share upsides like low taxes, a 10% flat rate for IT in Bulgaria and 0% on certain dividends in Romania, plus skilled worker inflows.

Risks and Mitigation Strategies

Both enjoy solid geopolitical footing as NATO and EU members, but Romania's size draws more cyber attention, so stick with GDPR-compliant partners to stay safe. Bulgaria's tinier scene might mean relying too much on one vendor, so mix in staff boosts to spread it out.

Inflation is low at about 3% in Bulgaria and 5% in Romania for 2025, pushing salaries a bit, but long-term contracts can lock in rates. Culturally, they're a good match with strong work ethics and straightforward talk. Check platforms like Clutch for rated partners, where Bulgaria averages 4.9 out of 5 and Romania 4.8.

Conclusion: Which is Best?

For startups or teams working within a tighter budget, Bulgaria offers a strong balance of affordability and engineering quality. For large enterprises that need scale, volume hiring, and formal certifications, Romania can be the better option. The right choice depends on the size and structure of your project, in some cases, a hybrid approach that combines both countries delivers the best results.

Bulgaria stands out as a mature IT outsourcing destination, with Sofia at the center of its tech ecosystem. The country is well known for strong engineering talent, particularly in areas like fintech and complex web systems. For companies looking for reliable software outsourcing in Eastern Europe, Bulgaria remains a practical, proven choice that combines technical depth with operational flexibility.